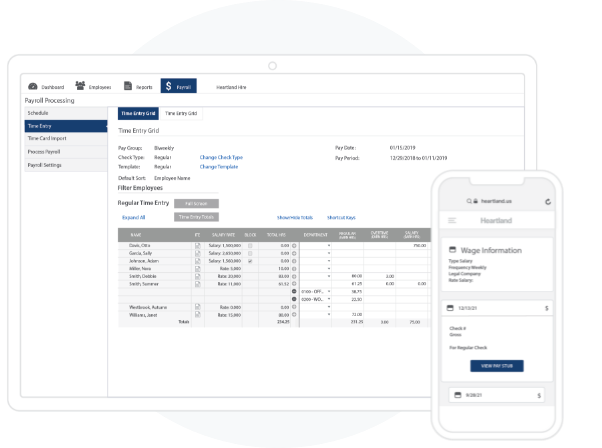

We've partnered with Heartland to bring you a payroll solution that works for all your business needs. Heartland Payroll processing eliminates guesswork so you can quickly and reliably submit payroll and payroll taxes on time - anywhere, from any internet-enabled device.

Complete the form to learn how Heartland Payroll can transform your business.

Heartland Payroll and its processing and tax management solutions yield the following benefits:

![]()

Calculate how much employees should be paid each pay period, whether it's weekly, bi-weekly, semi-monthly or monthly. Lets you pay wages, overtime, bonuses and commissions via direct deposit, paycard or check - and keep track of it all from a single dashboard.

![]()

Generates and downloads pre built, real-time reports for payroll history, bank transactions, contractor payments, paid time off, tax payments and more. Rely on the system to automatically report new hires to the government.

![]()

Enables you to spend less time answering employee questions by giving them controlled access to a self-service portal available on any internet-connected device. They can view their pay stubs, 1099s or W-2s, and update personal data, like their address and direct deposit information.

![]()

Trade guesswork for full-service tax management, including tax calculations, tax filing and automatic tax payments to federal, state and local agencies on your behalf.